However, you must always check additional fees, extra costs, and possible differences in interest rates or APR to make the right decision. To conclude, it is worth choosing a bi-weekly mortgage if you can afford it. Use our bi-weekly mortgage payment calculator with extra payments to check it in practice. You can learn about it more in our amortization calculator.īy boosting the payment frequency and paying a bit more through a bi-weekly mortgage, you accelerate the principal balance reduction, leading to a faster payoff and lower interest charges. As you proceed with the repayment, your principal balance drops gradually, which lowers the interest payment, making a faster reduction in the loan balance possible. More precisely, a larger part of your periodic payments covers the interest due to the high principal amount at the beginning of the repayment period. When your repayment follows an amortization schedule, your periodic payment remains constant, but its interest-principal proportion alters throughout the loan term. The crucial point that can make a considerable difference is amortization, a peculiar feature of most loans and mortgages. If you would like to check other ways to speed up your repayment, check our mortgage acceleration calculator, where you can choose multiple types of repayment frequencies.īut how do these relatively minor changes make such big a difference?

#15 year biweekly mortgage calculator how to#

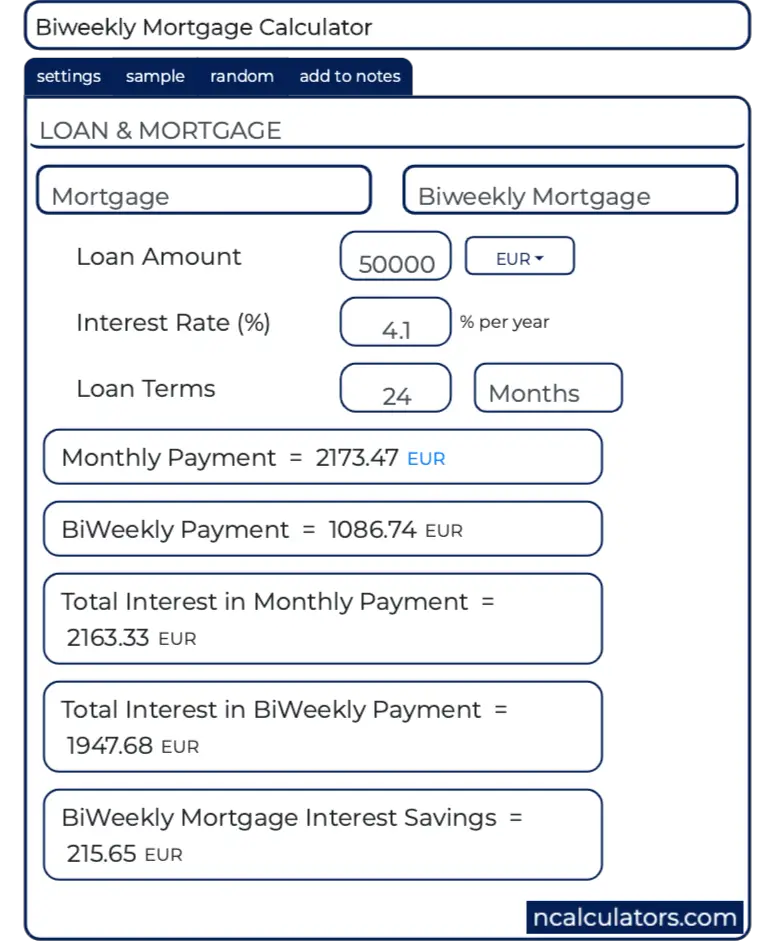

Of course, we will also explain how to apply this bi-weekly mortgage payment calculator with additional payments. Read further, and we will give you some advice on how to make bi-weekly mortgage payments and explain the difference between bi-weekly and accelerated bi-weekly mortgage payments.

To sum up, you can make any of the following comparisons: In addition, you can check how an extra principal payment would affect your schedule and interest cost so you can apply our tool as a bi-weekly mortgage calculator with extra payments as well. If your loan requires other types of insurance like private mortgage insurance (PMI) or homeowner's association dues (HOA), these premiums may also be included in your total mortgage payment.Is it better to make bi-weekly mortgage payments? You can quickly find the answer by comparing a bi-weekly mortgage to an alternative schedule using our bi-weekly mortgage payment calculator. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If you have an escrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. The "principal" is the amount you borrowed and have to pay back (the loan itself), and the interest is the amount the lender charges for lending you the money.įor most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner's insurance and taxes. Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. These autofill elements make the home loan calculator easy to use and can be updated at any point. Zillow's mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet.

0 kommentar(er)

0 kommentar(er)