Regulatory Choices in Dealing with Natural Monopoly. Table 11.3 outlines the regulatory choices for dealing with a natural monopoly.įigure 11.3. Points A, B, C, and F illustrate four of the main choices for regulation. So what then is the appropriate competition policy for a natural monopoly? Figure 11.3 illustrates the case of natural monopoly, with a market demand curve that cuts through the downward-sloping portion of the average cost curve. THE CHOICES IN REGULATING A NATURAL MONOPOLY Before the advent of wireless phones, the argument also applied to the idea of many different phone companies, each with its own set of phone wires running through the neighborhood. The same argument applies to the idea of having many competing companies for delivering electricity to homes, each with its own set of wires. Installing four or five identical sets of pipes under a city, one for each water company, so that each household could choose its own water provider, would be terribly costly.

It would make little sense to argue that a local water company should be broken up into several competing companies, each with its own separate set of pipes and water supplies. Public utilities, the companies that have traditionally provided water and electrical service across much of the United States, are leading examples of natural monopoly.

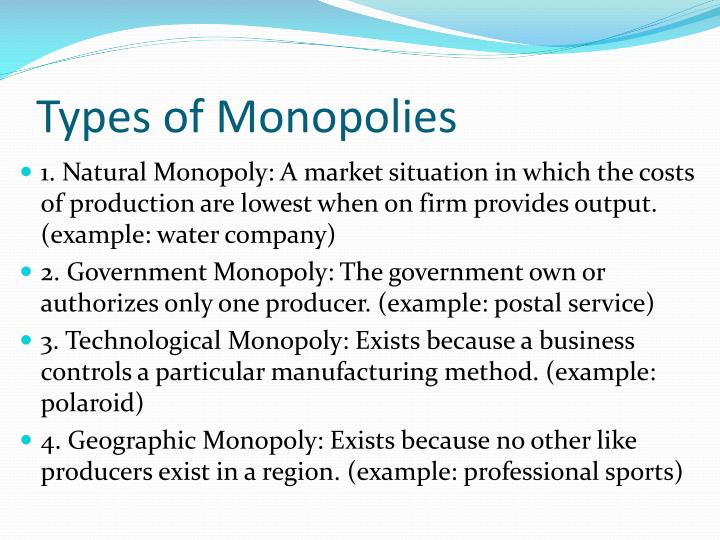

As a result, one firm is able to supply the total quantity demanded in the market at lower cost than two or more firms-so splitting up the natural monopoly would raise the average cost of production and force customers to pay more. This typically happens when fixed costs are large relative to variable costs. A natural monopoly arises when average costs are declining over the range of production that satisfies market demand. A natural monopoly poses a difficult challenge for competition policy, because the structure of costs and demand seems to make competition unlikely or costly.

0 kommentar(er)

0 kommentar(er)